japan corporate tax rate 2020

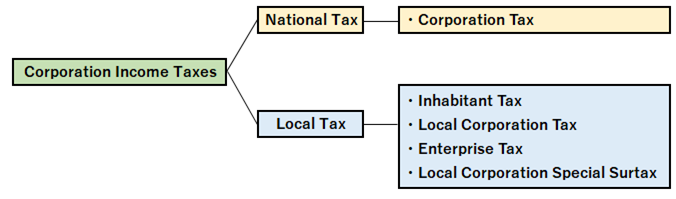

13 February 2020 Japan tax newsletter Ernst Young Tax Co. The regular business tax rates vary between 03 and 14 depending on the tax base taxable income and the location of the taxpayer.

Japan Further Discusses Lowering Their Corporate Rate Tax Foundation

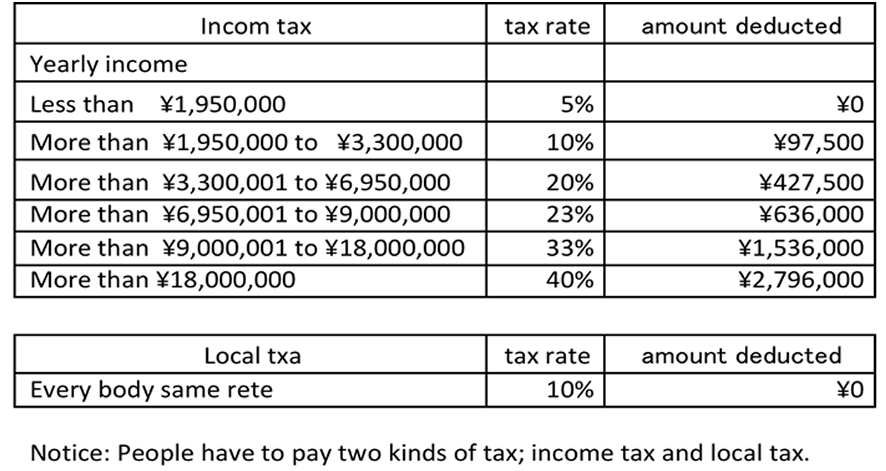

The income tax rates allowances thresholds rates and other payroll deductions and allowances displayed on this page are used by the 2020 payroll and tax calculators to calculate relevant.

. 22 hours agoRetained earnings of the overseas subsidiaries of Japanese firms totaled 376 trillion yen 261 billion in March 2021 according to the economy ministry. The Revenue Reconciliation Act of 1993 increased the maximum corporate tax rate to 35 for corporations with. Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2.

Data published Yearly by National Tax. The above amendments will be applied to tax years beginning on or after 1 April 2020. Tax rates for corporate income tax including historic rates and domestic withholding tax for more than 170 countries worldwide.

Corporate Tax Rate in Japan averaged 4083 percent from. It could have a. Taxable income over 10 million.

Corporate Tax Rate in Japan averaged 4119 percent from 1993 until 2020 reaching an all time high. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. NEW Due date of filing and payment.

The current income tax rate for corporates with paid-in capital of over 100 million yen is at 232. 2 Japan tax newsletter 13 February 2020 Corporate taxation 1. The Corporate Tax Rate in Japan stands at 3062 percent.

For small and medium-sized enterprises the first 8 million yen is levied at a. The deductible portion of a corporations net interest expense to a related party as. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching.

The maximum rate was 524 and minimum was 3062. GIG is a specialist group established to respond to the. Corporate Tax Rate in Japan remained unchanged at 3062 in 2021.

Dividends interest and royalties earned by non-resident individuals andor foreign corporations are subject to a 20 national WHT under Japanese domestic tax laws in. 2020 Japan tax reform outline. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Corporate Tax Rate in Japan averaged 4083 percent from.

:max_bytes(150000):strip_icc()/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-02-2d1d9e3a2450426893a7cb627c44baf9.jpg)

Countries With The Highest And Lowest Corporate Tax Rates

Economy And Politics 10 Talking Points Neither Party Will Give You

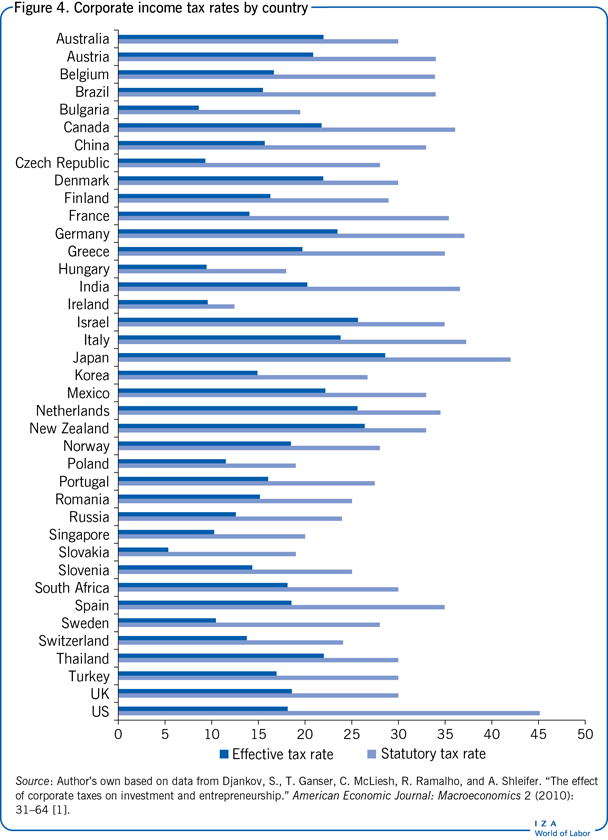

Iza World Of Labor Corporate Income Taxes And Entrepreneurship

Corporate Income Tax Return Filing In Japan Latest 2021 2022 Shimada Associates

Japan Corporate Tax Rate 2022 Data 2023 Forecast 1993 2021 Historical Chart

Corporate Tax Rate In Japan Ventureinq Accounting Firm In Japan Tokyo

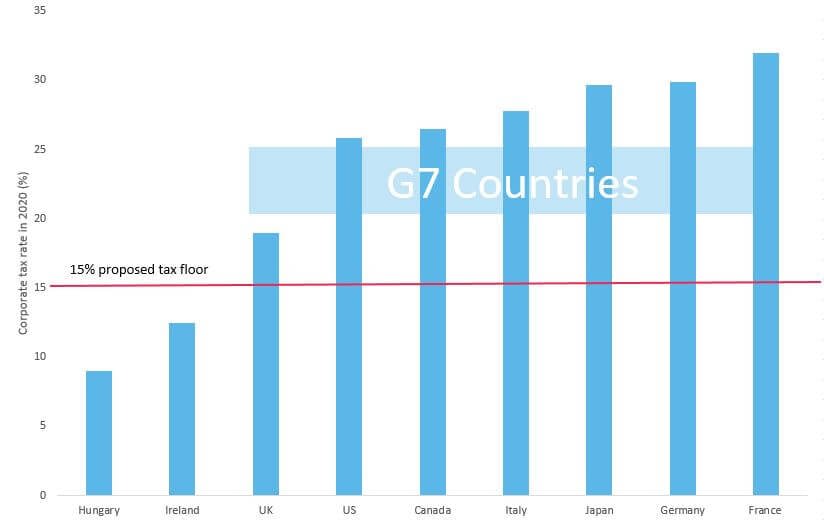

Corporate Tax Rates Around The World Tax Foundation

Corporate Tax In The United States Wikipedia

Tax Foundation On Twitter President Biden S Madeinamerica Tax Plan Would Make The U S Combined Corporate Tax Rate The Highest In The Oecd Biden Plan Current Law

Global Corporate Tax Overhaul Advances As 136 Nations Sign On

Eyeing The Global Commitment In Biden S Made In America Tax Plan

Is Labour Party S Plan To Raise Corporation Tax A Good Idea Financial Times

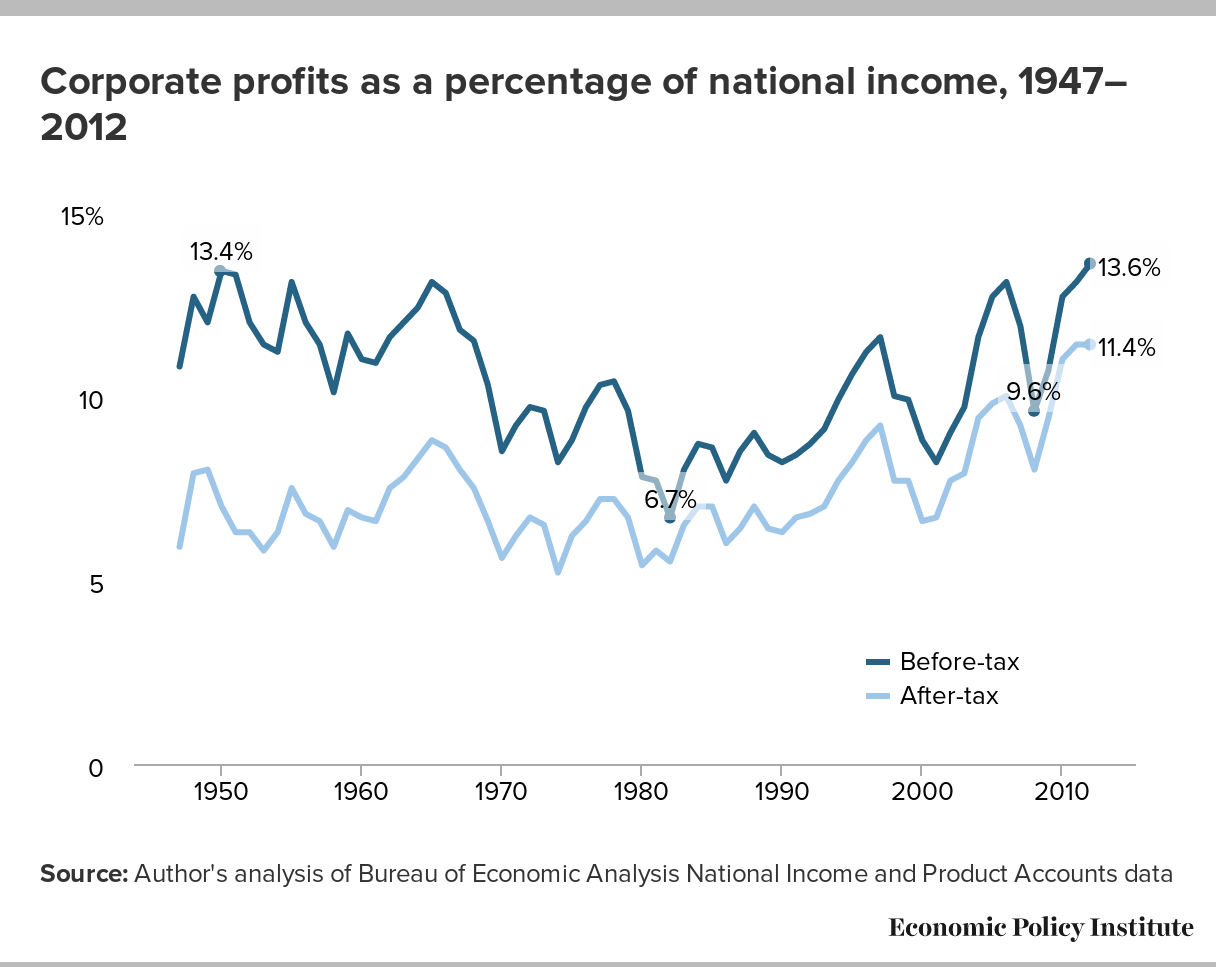

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Oecd Corporate Tax Rate Ff 01 04 2021 Tax Policy Center

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Corporate Tax Laws And Regulations Report 2022 Japan

International Comparisons Of Corporate Income Tax Rates Congressional Budget Office